The New Era of Banking Conversations

We are entering a new era where conversational AI in banking is reshaping how financial institutions engage with customers. The digital transformation that swept through banking in the past decade paved the way, but today’s landscape is defined by AI-driven conversations—personalized, responsive, and available around the clock. In 2025, over 70% of customers expect instant, seamless support across digital channels, and banks face mounting pressure to deliver. Those who harness conversational AI are seeing up to a 30% reduction in operational costs and a significant lift in customer satisfaction. The ROI is clear: banks that lead with conversational AI gain a powerful competitive advantage in both experience and efficiency.

What is Conversational AI in Banking?

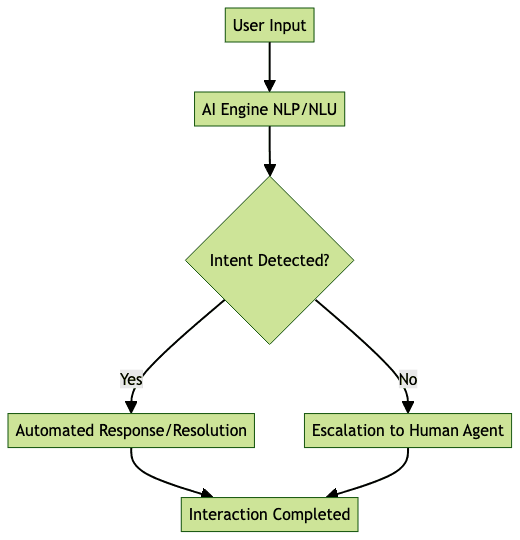

Conversational AI in banking refers to the suite of technologies—including natural language processing (NLP), natural language understanding (NLU), and generative AI—that enable banks to interact with customers via voice, chat, or video as naturally as speaking to a human advisor. The journey began with rule-based chatbots capable of handling simple FAQs. Next came AI-powered chatbots, which used machine learning to understand intent and provide context-aware responses. Now, generative AI is raising the bar, delivering hyper-personalized interactions and drawing insights from vast data sets in real time.

For those interested in building these capabilities, the

Voice Agent Quick Start Guide

offers a practical entry point to rapidly deploy conversational AI solutions tailored for banking environments.

The evolution from basic automation to intelligent, conversational agents is enabling banks to move from transactional support to truly transformative customer experiences.

Why Banks Are Betting Big on Conversational AI

Today’s banking customers demand more—instant answers, personalized recommendations, and seamless omnichannel support. Conversational AI in banking meets these expectations and more. With AI, banks can provide 24/7 service, handle enormous volumes of queries without expanding headcount, and offer tailored experiences that boost loyalty.

To understand the architecture behind these solutions, reviewing an

AI voice Agent core components overview

can help banks identify the essential building blocks for scalable, secure, and effective AI deployments.Operationally, conversational AI drives major cost efficiencies. Automated agents resolve routine queries, freeing human staff for high-value tasks. AI-driven triage ensures customers are routed to the right resource the first time, improving first contact resolution (FCR) and reducing average handling time (AHT). Regulatory environments add another driver: AI enables secure, consistent adherence to compliance requirements, with audit trails and real-time monitoring built in.

| Service Metric | Traditional Banking | Conversational AI Banking |

|---|---|---|

| Average Response Time | Hours/Days | Seconds |

| First Contact Resolution | 60% | 85% |

| Cost per Interaction | $5-8 | $1-2 |

| Customer Experience | 3.5/5 | 4.6/5 |

| Availability | 9am-5pm | 24\x7 |

Banks that build their own conversational AI are not just automating—they’re future-proofing their operations and unlocking new value streams.

Real-World Use Cases: Where Conversational AI Adds Value

Conversational AI in banking is more than a chatbot on a website. It’s a strategic platform for driving automation, growth, and superior experiences across a bank’s digital ecosystem:

- Customer Support Automation: Automated agents handle routine queries—account balances, transaction histories, password resets—instantly and with high accuracy, freeing up human agents for complex cases. Effective

conversation flow in AI voice Agents

ensures these interactions feel natural and intuitive for customers. - Proactive Financial Guidance & Cross-Selling: AI can analyze a customer’s profile and spending habits to suggest relevant financial products, send timely account alerts, or offer budgeting tips, increasing both customer value and product adoption. Managing

AI voice Agent Sessions

allows banks to maintain context across multiple interactions, enhancing personalization. - Fraud Detection & Escalation: Conversational AI can flag suspicious activity in real time, prompt the customer for verification, and escalate to compliance teams as needed—all while maintaining a seamless experience. Incorporating

Human-in-the-loop for AI voice Agents

ensures that complex or sensitive issues are efficiently escalated to human experts when necessary. - Multilingual & Accessibility Benefits: AI agents offer support in multiple languages and formats, ensuring inclusivity and widening the bank’s reach. Robust

AI voice Agent tracing and observability

tools help banks monitor and optimize these diverse interactions for quality and compliance. - Internal Efficiency: AI-powered agent assist tools provide real-time suggestions and automate repetitive tasks, enhancing staff productivity and reducing errors. Leveraging plugins like the

OpenAI LLM Plugin for voice agent

andElevenLabs TTS Plugin for voice agent

can further enhance the intelligence and naturalness of AI-driven conversations.

Banks that build these capabilities are not just improving service—they’re reimagining the customer journey end-to-end.

Tangible Benefits: The ROI of Conversational AI in Banking

Investing in conversational AI in banking delivers clear, measurable returns:

- Revenue Growth: Hyper-personalized recommendations and proactive cross-selling drive higher conversion rates and faster adoption of new products.

- Cost Reduction: Automating routine interactions leads to call deflection rates of up to 40%, while human agents become more productive and engaged in meaningful work.

- Customer Retention and Satisfaction: AI delivers faster, more accurate responses, lifting NPS scores and reducing churn. According to Accenture, banks deploying conversational AI see customer satisfaction rise by up to 20%.

- Security and Compliance: AI ensures every interaction is tracked, secure, and compliant with evolving regulations—critical for protecting sensitive financial data.

Industry leaders like Forrester and IBM confirm that conversational AI in banking can reduce operating costs by millions annually, while unlocking new growth and retention opportunities.

Overcoming the Challenges

Building conversational AI in banking comes with its own set of hurdles. Integrating modern AI with legacy core banking systems requires careful planning to ensure smooth data flow and service continuity. Data privacy is paramount—banks must implement robust encryption, consent frameworks, and audit capabilities to meet regulatory demands. Maintaining a consistent brand voice, even as AI agents handle more inquiries, is crucial for trust and compliance. Finally, AI systems must be designed to gracefully hand off complex or sensitive issues to human agents, ensuring customer needs are always met.

For deployment at scale, following best practices for

AI voice Agent deployment

can help banks minimize risk and accelerate time-to-value.Forward-thinking banks factor these challenges into their build strategy, choosing flexible, secure platforms that support continuous improvement.

The Future: Hyper-Personalized, Omnichannel Experiences

The future of conversational AI in banking is hyper-personalized and omnichannel. AI will anticipate customer needs, offering proactive recommendations and support across voice, chat, video, and app interfaces. Seamless channel switching—starting with a text, moving to video, and following up in-app—will be the norm. AI will serve as both advisor and assistant, making banking simpler, smarter, and more human than ever before.

The Builder’s Blueprint: Creating Conversational AI in Banking with VideoSDK

Leaders looking to build conversational AI in banking need a clear, actionable blueprint. Here’s what’s required for a secure, scalable, and differentiated solution:

The Core Components You’ll Need

| Component | Function | Integration Tips |

|---|---|---|

| NLP/NLU Engines | Understand and process natural language | Choose models trained on financial data |

| Secure Data Connectors | Access core banking and CRM systems | Ensure encryption and audit trails |

| Omnichannel Interfaces | Customer touchpoints (chat, voice, video) | Use APIs for seamless channel switching |

| Real-Time Analytics | Monitor, optimize, and report interactions | Integrate with BI tools for insights |

Each component must be enterprise-grade—scalable, secure, and adaptable to the unique workflows of your institution.

For hands-on experimentation and rapid prototyping, the

AI Agent playground

provides a valuable environment to test and refine conversational AI features before full-scale deployment.The Critical Challenge: Real-Time Orchestration

The real differentiator in conversational AI in banking is real-time orchestration. When a customer engages, your AI must instantly interpret context, route the interaction appropriately (self-service, escalation, or compliance review), and provide a seamless resolution. Real-time orchestration is key for delivering great customer experience, maintaining security, and ensuring compliant workflows at scale.

Without robust orchestration, even the best AI agents can falter—leading to compliance risks, security gaps, and poor customer experiences.

The Solution: The VideoSDK Agents Framework

This is where the VideoSDK Agents Framework becomes your essential partner. VideoSDK empowers banks to build secure, scalable conversational AI applications across voice, chat, and video channels—fast.

- Agent Orchestration: VideoSDK routes every customer interaction in real time, ensuring the right balance of automation and human touch. Escalations, compliance checks, and multi-channel journeys are handled seamlessly.

- Security and Compliance: With enterprise-grade encryption, permissioning, and built-in auditability, VideoSDK ensures every interaction meets the highest banking standards.

- Omnichannel Excellence: VideoSDK enables true channel fluidity—customers can start in chat, move to voice or video, and receive consistent support everywhere.

- Rapid Prototyping: The framework allows your teams to design, test, and deploy new AI banking features quickly, adapting to changing market needs.

A typical workflow with VideoSDK: A customer’s query—via chat, voice, or video—is analyzed in real time by the AI engine. If the issue is routine, the AI resolves it instantly. If it’s complex, VideoSDK orchestrates a seamless handoff to a human specialist, preserving the full interaction context. Every step is monitored, secure, and optimized for both compliance and customer satisfaction.

Ready to lead the next wave of banking innovation? Start building with VideoSDK and transform your customer experience from the inside out.

Conclusion: Banking on Conversational AI—Why the Time is Now

Conversational AI in banking is no longer a future ambition—it’s the competitive edge banks need today. The benefits are too great and the market moves too quickly to wait. Leaders who invest in building robust, secure conversational AI will unlock new growth, efficiency, and customer loyalty. With VideoSDK as your technology partner, the path to AI-powered banking success has never been clearer—or more achievable.

Want to level-up your learning? Subscribe now

Subscribe to our newsletter for more tech based insights

FAQ